Indonesia is set to become the sixth-largest economy in the world by 2027, outsizing developed markets like the UK, France and South Korea. [1]

Home to 270M people, the fourth largest population globally, there is significant spending potential in the country’s young population. One of the spending areas growing quickly is streaming content. Since Covid, the use of music and video streaming services in Indonesia has grown significantly. In a 2022 Statista survey, watching movies, series or listening to music were among the most popular leisure activities in the country. [2]

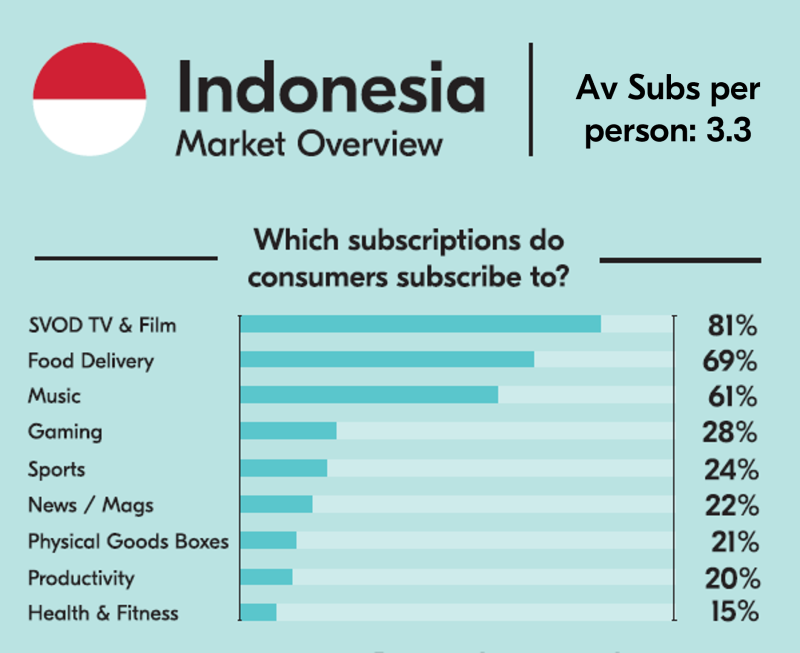

In 2022, the adoption rate of video & music streaming services was around 60% [3]. However, a more recent Bango survey, conducted in October 2023 [4], showed that video streaming adoption has grown further with 81% of respondents now subscribed to a Video or TV on demand service. Compared with other Asian countries, Indonesia has the highest preference for watching OTT content on smartphones, [5] so part of this growth could be attributed to the rollout of 5G tech across the country, making streaming content both higher quality and more accessible. Music subscriptions remain flat with 61% of respondents subscribed to a music service but new categories are gaining popularity, with 69% of respondents now subscribed to a food delivery service.

Indonesians have 3.3 subscriptions on average and, with the number of subscriptions on offer rising, are increasingly looking to bundling as a way of acquiring and managing those subscriptions. In the same Bango survey, 94% of respondents said they wanted a way to manage all of their subscriptions in one place, with 88% believing their mobile carrier was the right provider to do this. Interestingly, 96% of people said super bundling would increase their loyalty to the provider of the subscription hub and 90% would likely take out additional services like Netflix or Disney if offered as part of a bundle.

While markets like the USA are at the front of the curve when it comes to super bundling, emerging markets like Indonesia are catching up. Perhaps we will quickly see that 3.3 subscriptions per person rising as content providers look further afield as a means of continuing the growth of their subscriber base.

In addition, a report by FitchRatings released in August 2023 [6], forecast the ARPU of the major Indonesian telcos to increase during the course of 2023 as they focused on high value subscribers rather than competing on price. They are concentrating on getting subscribers to engage more and to top-up consistently. This will give telos a better understanding of their customers, enabling them to grow customer spend and stickiness. These same factors; higher ARPU, increased engagement, lower churn, that the telco can generate, to an extent, using their own first-party services are amplified significantly when using third-party services via the Bango DVM. By bundling exciting subscription services like Netflix, Spotify, Bigo or Amazon Prime, telcos can more proactively engage and retain customers while earning additional revenue on top. What’s more, by using Bango to do so, they can benefit from data insights that maximize the performance of offers and increase user interaction even further.

The USA might be leading the charge when it comes to super bundling but we see telcos in Asian markets, like Indonesia, catching up quickly.

References:

[1] https://www.ft.com/content/4e442979-36c7-47c3-9682-46a5d199a752

[2] https://www.statista.com/statistics/1343004/indonesia-popular-streaming-platforms/

[3] https://www.statista.com/topics/10520/streaming-in-indonesia/#topicOverview

[4] https://bango.com/unified-subscriptions-fuel-customer-loyalty-in-southeast-asia-india/

[5] https://www.statista.com/statistics/1332253/apac-leading-devices-for-watching-video-content-by-country/

[6] https://www.fitchratings.com/research/corporate-finance/indonesian-telcos-2023-arpu-to-rise-on-rational-competition-10-08-2023