As with many industries, there is a lot of jargon in the tech industry. It is easy to get lost in the detail and skip over the fundamentals. In this blog, I will focus on direct carrier billing (DCB) – how it works and the relevance of DCB in the UK.

First, what is direct carrier billing? Direct carrier billing (sometimes called mobile carrier billing) is simply the mechanism for charging an online payment to your mobile phone bill, instead of a credit card, debit card, or wallet like PayPal.

How does it work for the consumer? It might sound complicated but it is actually simpler and faster than paying with a credit or debit card. You can charge to your mobile phone bill with the simple click of a button. The charge will then show up on your monthly bill if you are a contract customer or, if you pay as you go, the charge will be deducted straight from your top-up balance.

Where does Bango fit? Bango has deep integrations with hundreds of mobile network operators (sometimes called carriers or telcos), which means we can automatically verify a legitimate user and ask their carrier to charge their phone bill without the user having to register details of their account. This makes the consumer payment much faster and less error-prone than entering card details, billing address details etc.

DCB in the UK: Unlike in other parts of the world, DCB adoption in the UK is lower than the use of cards online. It is most popular with Gen Z consumers, gamers, and app users but DCB use is growing and is perhaps more prevalent than most people realize. I expect many of you reading will have used one of the DCB examples below.

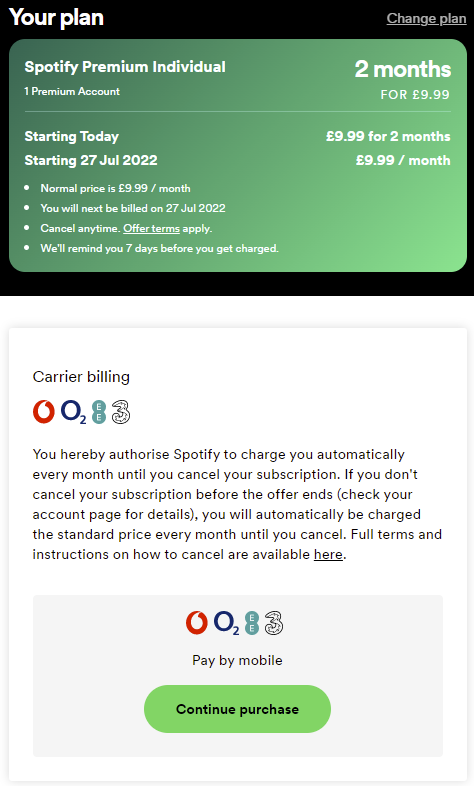

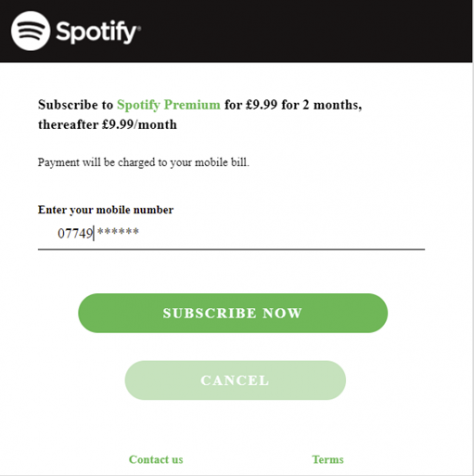

- Taking out a Subscription Service:

53% of UK consumers with a music streaming subscription have a Spotify account. When you take out a Spotify subscription, you can choose carrier billing as your chosen payment method. No need to enter payment information, simply enter your mobile number, hit subscribe and you’re ready to go! The charge will then be added to your mobile phone bill each month. As you can see in the image below, this payment method is supported by the UK’s 4 leading carriers: Vodafone, O2, EE and Three.

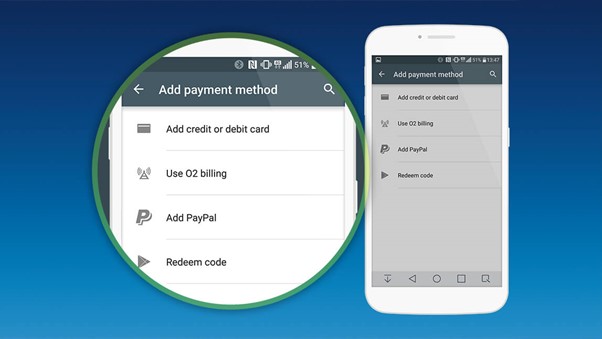

- Paying in the Google Play Store:

If you buy an app from the GooglePlay store, or make an in-app payment, rather than adding credit card payment information, you could charge the item straight to your mobile phone bill. If you have a contract with your mobile operator, the charge will simply be added to your monthly bill or if you are a pay as you go customer, the charge will be deducted from your available credit (providing you have sufficient funds available). The example below shows carrier billing with mobile network operator O2.

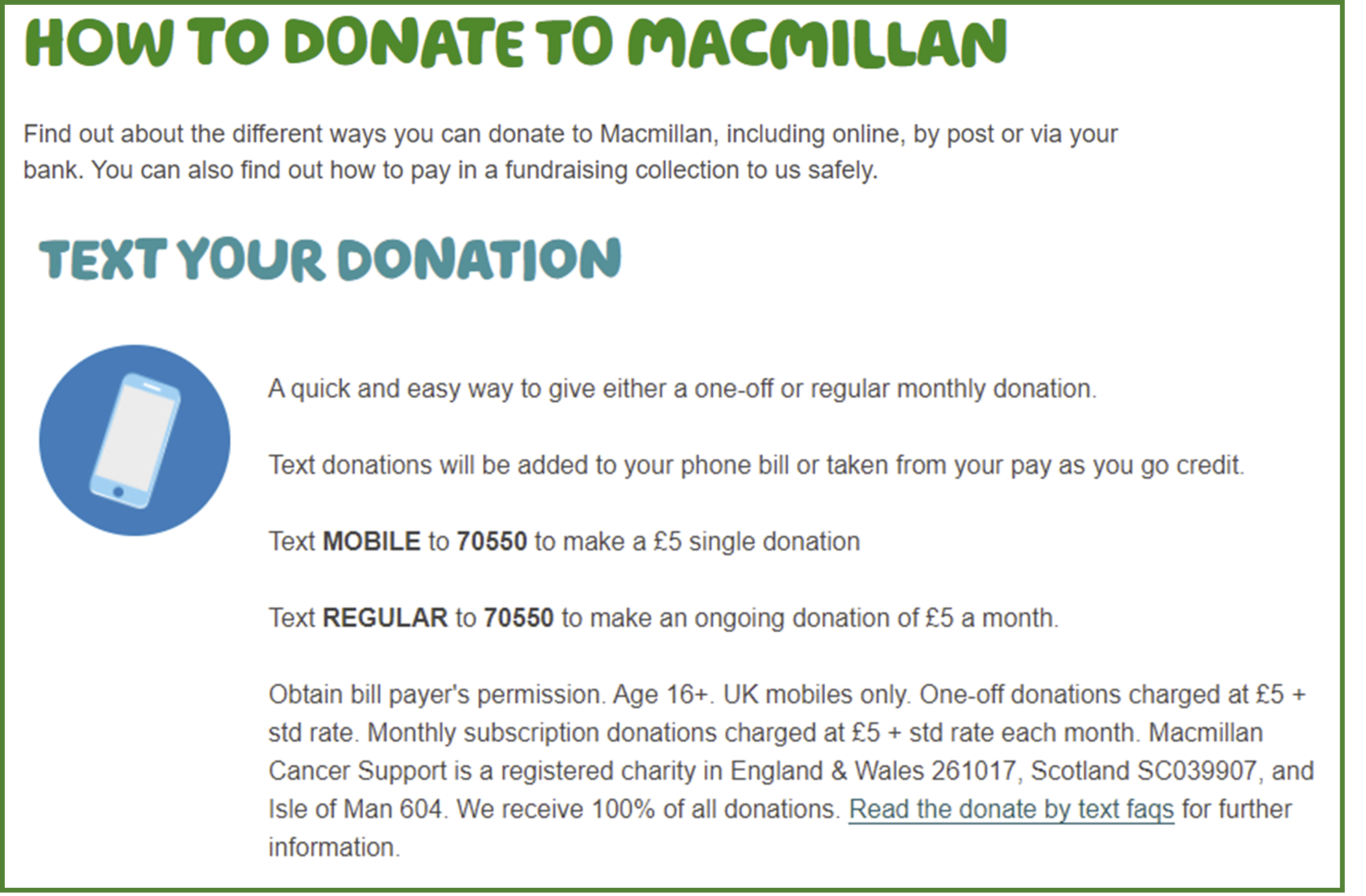

- Donating to Charity:

The other most common uses for carrier billing in the UK are donating to charities, voting on television shows or taking part in television competitions. The example below is with cancer charity, Macmillan. Many charities now offer the ability to make a donation, especially a recurring donation, by charging it straight to your mobile phone bill.

What does the customer get out of using DCB? A few of the benefits include:

- It’s quick – click to select carrier billing and away you go. No need for long card numbers, with expiry dates etc.

- It’s accessible – millions more people have a mobile phone than have a credit card.

- It’s secure – no need to share your card information online.

- It’s built-in to the mobile user experience – there is no need to download a special Bango app or any other software to use DCB. The simple fact that you have a mobile phone account means that you can pay using DCB.

DCB is used across the world. It is very common in some unexpected markets – Japan, Korea, the Middle East – even though card ownership is very high in those countries.

How has DCB become a significant payment method? As I’ve described above, there are many customer benefits for using DCB. But the widespread availability of DCB is down to companies like Bango making it very easy for merchants and app stores to offer it to their customers.

Bango enhances DCB in the following ways:

- The Bango platform makes DCB work like a single, global payment method. We do this by standardizing technical APIs (you can think of this like Google Translate – Bango sits in the middle and translates messages from the merchant and the telco so they can communicate), reporting and financial operations. The merchant or store integrates once to Bango and can offer DCB to users everywhere.

- Bango is invisible to the consumer, providing the core technology behind the scenes that enables users to charge to their telco bill. The user doesn’t have to take any additional steps to benefit from DCB that is enabled by Bango.

- Bango technology analyses data across billions of dollars of DCB payments, providing actionable insights that boost payment performance for all merchants using the Bango platform.

Subscribe below to keep up to date with all the latest Bango investor news & blogs.